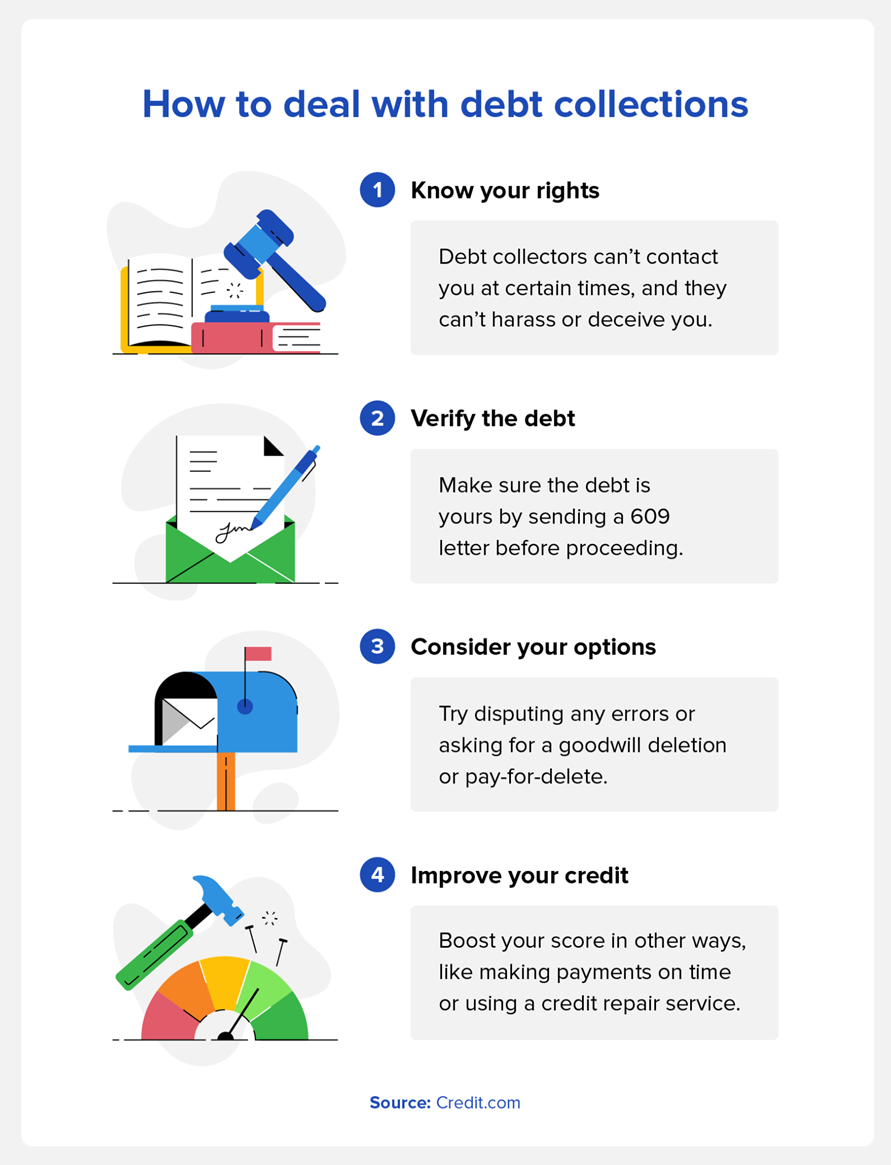

Top Notch Info About How To Deal With Credit Collections

Here's how collections affect your credit and how to handle it.

How to deal with credit collections. The first is that a credit card issuer. Debt collectors are allowed to contact you by phone, letter, email, or text message to try and collect on a debt. Create a payment plan creating a payment plan lets you set a payment schedule and amount that works for your budget.

By ben luthi | feb. However, any message they send must clearly. Gather the facts when the original creditor sells a debt to a third party — which might go on to.

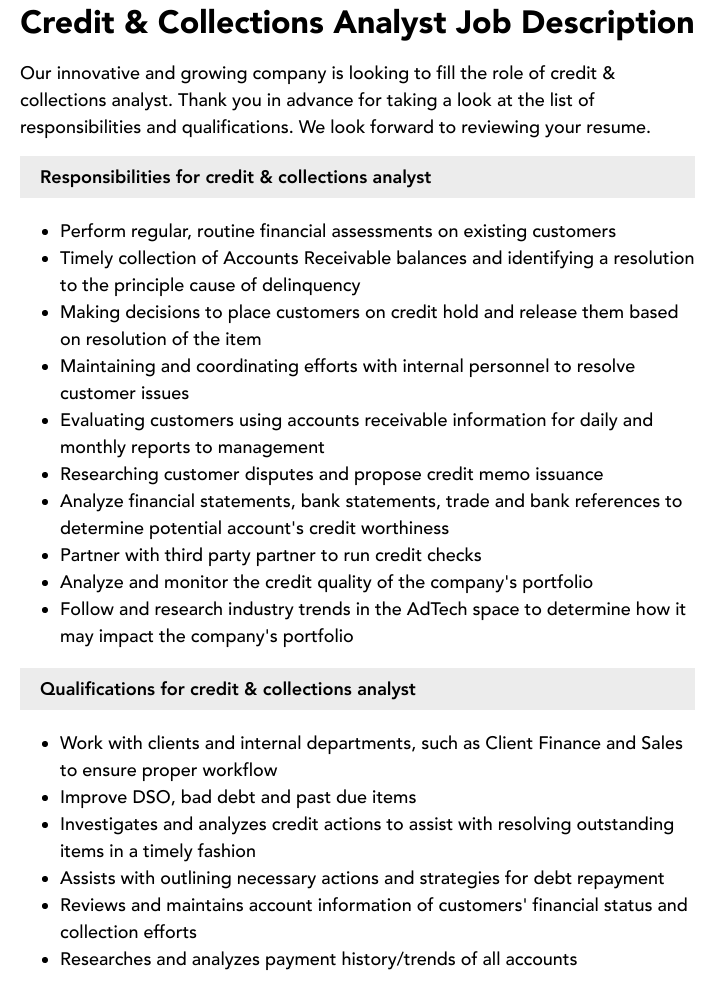

3 steps for dealing with a debt collector 1. There are a couple of possibilities here. Deal with collections [complete guide] :

Don't give in to pressure to pay on first contact just as you wouldn’t jump into a contract without understanding its. A guide to credit card debt. Verify the debt is accurate.

Why might you have to deal with debt collectors? Contact you at home. Get the name of the person, company name, address and phone number.

Federal law protects you from being harassed or treated unfairly during the debt collection process. Collections accounts on your credit report can linger for up to seven years and drag down your score. Confirm that you owe the debt when debt collectors contact you, they must give you certain information about the debt they say you owe or they should.

How to deal with debt collectors if you get a call from a debt collector, you shouldn't ignore it. First, know your rights. This includes correcting mistakes like a.

Identifying a legitimate debt collector recognizing debt collection scams debt collection scams can lead to identity theft and financial loss, so it’s essential to. Should the dreaded day arrive, and a company called credit collection services (ccs) contacts you for a. 12, 2019, at 9:00 a.m.

How to deal with credit collection services. Capital one financial is buying discover financial services for $35 billion, in. But don’t volunteer any information of your own.

Then, make sure to validate the debt. When a creditor or debt collector sues you for unpaid credit card debt, here are some actions you might want to consider taking.

![[PDF] Essentials of Credit, Collections, and Accounts Receivable by](https://book-extracts.perlego.com/2758962/images/201.svg)