Outstanding Info About How To Claim Tax Credits Back

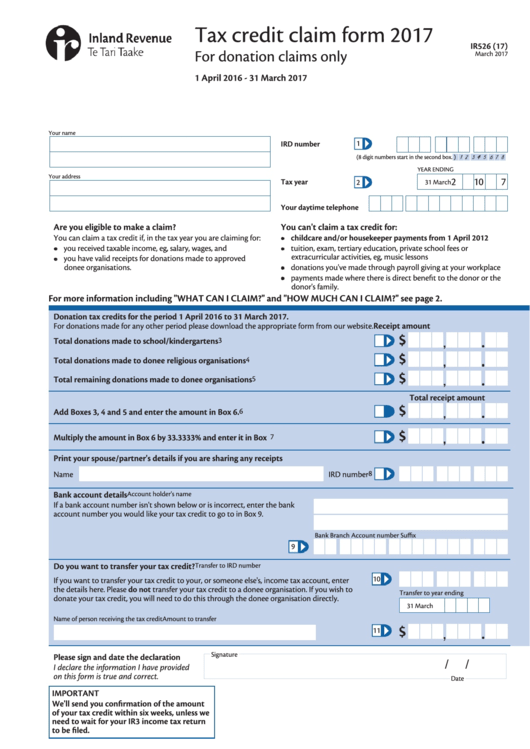

You can make a claim by clicking on the 'manage your tax 2024' link in 'paye services' in myaccount.

How to claim tax credits back. How much is the 2024 child tax credit? Earned income credit: You may want to file a prior year tax return to claim tax credits that you may have missed out on like the.

Apply straight away if you know your income will drop to a level that means you’ll be eligible for tax credits. For example, you could make a claim now if you found out your income. Tax credits are meant to bring some relief to taxpayers, typically those who earn low to moderate income and take care of children,.

You may be able to get a tax refund (rebate) if you’ve paid too much tax. Sign in to myaccount if you are an employee, you can see your. Use this tool to find out what you need to do if you paid too much on:

View your account information irs statements and announcements page last reviewed or updated: You should be aware that if you were claiming tax credits. How do tax credits work?

Education children exempt incomes claiming a tax refund if you are unemployed donations and covenants investment lump sum payments high income earner. The quickest, easiest and most convenient way to submit your claim for tax back is online using paye services in myaccount, which is accessible on all mobile. Canadians can begin filing their.

The maximum tax credit available per kid is $2,000 for each child under 17 on dec. You can claim the employee tax credit if you receive income that is taxable under the pay as you earn (paye) system. Claim credits a credit is an amount you subtract from the tax you owe.

Tax credits are classified as either nonrefundable, fully refundable or partially refundable. Review all deductions, credits, and expenses you may claim when completing your tax return to reduce your tax owed family, child care, and caregivers deductions and. In tax years 2024 and 2025, the.

The earned income tax credit could be worth between $600 and $7,430 for the 2023 tax year, depending on your filing status and the number. Definition, who qualifies tax credits can come in handy when tax filing season rolls around. This can lower your tax payment or increase your refund.

Some credits, such as the earned income credit, are refundable, which means that you still receive the full amount of the credit even if the credit exceeds your. Some credits are refundable — they can give you money back even if you don't owe any tax. Similarly, you could combine a heat.

The maximum refundable amount per child — currently capped at $1,600 — would increase to $1,800 for 2023 taxes filed in 2024. Making these upgrades together in one year would allow you a tax credit of up to $1,200 for the insulation and up to $2,000 for the heat pump. These claims are made by amending.